Steelcase Reports Fourth Quarter and Fiscal 2023 Results

Steelcase Inc. (NYSE: SCS) today reported fourth quarter revenue of $801.7 million, net income of $15.7 million, or $0.13 per share, and adjusted earnings per share of $0.19. In the prior year, Steelcase reported revenue of $753.1 million and a net loss of $2.2 million, or $0.02 per share, and had $0.01 adjusted earnings per share.

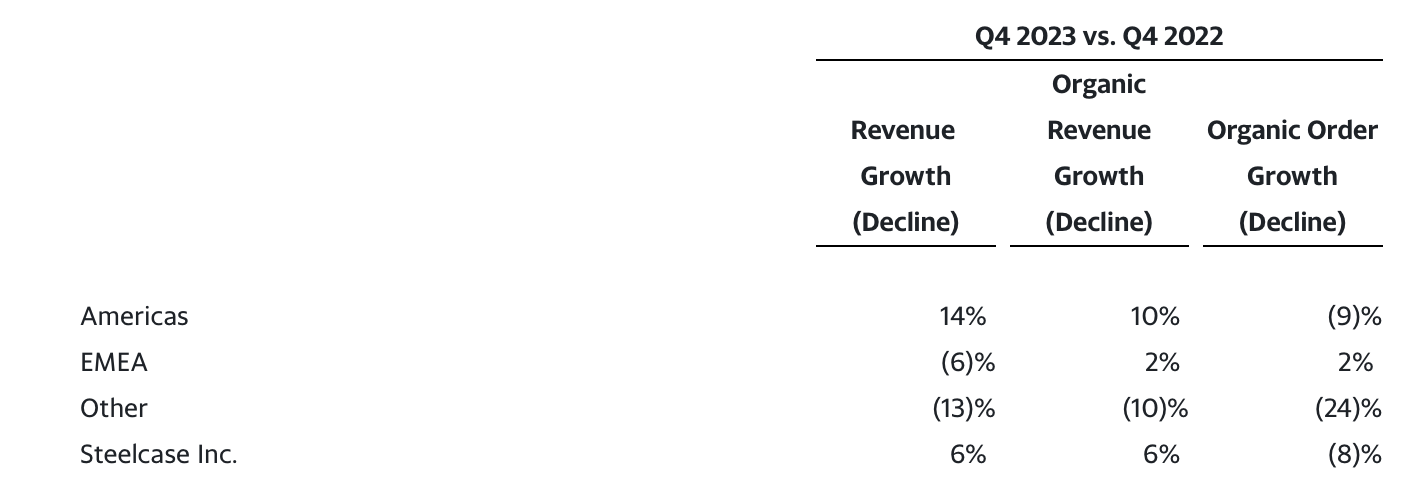

Revenue and order growth (decline) compared to the prior year were as follows:

Revenue increased 6 percent in the fourth quarter compared to the prior year and 6 percent on an organic basis. The revenue growth was driven by 14 percent growth in the Americas, while EMEA declined 6 percent and the Other Category declined 13 percent. On an organic basis, revenue grew 10 percent in the Americas and 2 percent in EMEA but declined 10 percent in the Other category. The Americas growth was primarily driven by higher pricing but also benefited from faster order fulfillment patterns. The decline in the Other category was primarily driven by Asia Pacific and the impact on demand in previous quarters from COVID-related restrictions in China.

Orders (adjusted for the impact of an acquisition, divestitures and currency translation effects) declined 8 percent in the fourth quarter compared to the prior year. Orders declined 9 percent in the Americas and 24 percent in the Other category, while EMEA grew 2 percent. The order decline in the Americas in the fourth quarter was less than the 16 percent year-over-year decline posted in the third quarter, primarily due to increased project orders from large corporate customers. Order patterns in the Other category reflected lingering effects of COVID-related restrictions in China and declines across all other markets in Asia Pacific.

"In the Americas, our fourth quarter orders were stronger than we anticipated and drove revenue and earnings above our expectations," said Sara Armbruster, president and CEO. "Although our fourth quarter orders were below the prior year, project business from large corporate customers improved sequentially from the third quarter. We’ve seen opportunity creation in the Americas grow on a year-over-year basis for eight of the last nine months, and in recent months, a notable number of larger companies in the United States have announced workplace strategies that emphasize the importance of an in-office presence."

Operating income (loss) and adjusted operating income (loss) were as follows:

Operating income of $28.7 million in the fourth quarter represented an increase of $26.6 million and 330 basis points as a percentage of revenue compared to the prior year. Adjusted operating income of $38.6 million in the fourth quarter (which excludes $3.9 million of restructuring costs and $6.0 million of amortization of purchased intangible assets) represented an increase of $32.5 million compared to the prior year. The increase in adjusted operating income was driven by a $42.7 million increase in the Americas, partially offset by a $4.5 million decrease in EMEA and a $6.1 million decrease in the Other category. The increase in the Americas was primarily driven by higher pricing benefits, net of inflation, partially offset by lower volume and higher operating expenses. The decrease in EMEA was primarily driven by higher operating expenses and lower volume, partially offset by higher pricing benefits, net of inflation. The higher operating expenses in EMEA were primarily driven by a $2.6 million increase in the valuation of an acquisition earnout liability and $2.3 million of higher variable compensation expense due to higher global profitability driven by the Americas. The decrease in the Other category was primarily driven by lower revenue and higher operating expenses.

Gross margin of 29.8 percent in the fourth quarter represented an increase of 370 basis points compared to the prior year and reflected a 570 basis point improvement in the Americas, a 30 basis point decline in EMEA and a 90 basis point decline in the Other category. Year-over-year pricing benefits, net of year-over-year inflation, were approximately $85 million. The decline in EMEA was primarily due to the impact of lower volume, partially offset by higher pricing benefits, net of inflation, and the decline in the Other category was primarily due to the impact of lower volume.

"Similar to recent quarters, our gross margin improvement in the Americas this quarter reflected the benefits from the pricing actions we’ve been implementing to recover the significant inflationary costs we’ve absorbed over the past two years," said Dave Sylvester, senior vice president and CFO. "We estimate the cumulative benefits from our pricing actions over the last two years approximate the cumulative inflation we’ve incurred through the end of the fourth quarter."

Operating expenses of $206.8 million in the fourth quarter represented an increase of $12.5 million compared to the prior year. The increase was driven by $15.3 million of higher variable compensation expense, $6.5 million from an acquisition, and a $5.2 million increase in the valuation of an acquisition earnout liability (of which $2.6 million was recorded in each of the Americas and EMEA segments), partially offset by $9.2 million of gains on sales of fixed assets, $2.7 million of lower spending and employee costs, and $2.7 million of favorable currency translation effects.

Total liquidity, comprised of cash and cash equivalents and the cash surrender value of company-owned life insurance, aggregated to $247.7 million at the end of the fourth quarter, representing a $31.5 million improvement compared to the end of the third quarter. Total debt of $481.2 million represented a $34.8 million decrease compared to the end of the third quarter, as the company repaid all borrowings under its credit facility during the quarter. Adjusted EBITDA for the trailing four quarters was $210.0 million.

The Board of Directors has declared a quarterly cash dividend of $0.10 per share, to be paid on or before April 14, 2023, to shareholders of record as of April 5, 2023.

Fiscal 2023 Results

For fiscal 2023, the company recorded $3.2 billion of revenue, net income of $35.3 million, earnings per share of $0.30 and adjusted earnings per share of $0.56. In fiscal 2022, the company recorded $2.8 billion of revenue, net income of $4.0 million and earnings per share of $0.03 and had adjusted earnings per share of $0.13.

Revenue increased 17 percent in fiscal 2023, with a 23 percent increase in the Americas, a 2 percent increase in EMEA and a 5 percent increase in the Other category. On an organic basis, fiscal 2023 revenue represented an increase of 17 percent compared to the prior year, with a 20 percent increase in the Americas, a 13 percent increase in EMEA and an 8 percent increase in the Other category.

Operating income for fiscal 2023 of $65.5 million represented an increase of $45.4 million compared to $20.1 million of operating income for fiscal 2022. Adjusted operating income for fiscal 2023 of $107.5 million represented an increase of $72.6 million compared to $34.9 million of adjusted operating income for fiscal 2022. The increase in adjusted operating income was driven by significant pricing benefits, net of inflation, and higher volume, partially offset by higher operating expenses.

"Fiscal 2023 was a pivotal year for Steelcase, and I’m proud of how we managed through the extraordinary inflationary pressures and supply chain challenges to deliver 17 percent revenue growth and significant earnings improvement," said Sara Armbruster. "Our employees showed tremendous commitment and resilience in delivering these results."

Outlook

At the end of the fourth quarter, the company’s backlog of customer orders was approximately $690 million, which was 14 percent lower than the prior year. Orders through the first three weeks of the first quarter of fiscal 2024 were flat compared to the prior year. As a result, the company expects first quarter fiscal 2024 revenue to be in the range of $710 to $735 million. The company reported revenue of $740.7 million in the first quarter of fiscal 2023. The projected revenue range translates to a decline of 1 to 4 percent compared to the prior year, or an organic decline of 2 to 5 percent.

The company expects to report earnings (loss) per share of between ($0.02) to $0.02 for the first quarter of fiscal 2024 and adjusted earnings per share of between $0.01 to $0.05. The company reported a loss per share of $0.10 and an adjusted loss per share of $0.05 in the first quarter of fiscal 2023.

The first quarter estimates include:

gross margin of approximately 29.5 percent, with projected pricing benefits, net of moderate inflation, of approximately $55 million as compared to the prior year,

projected operating expenses of between $205 to $210 million, which includes $4.3 million of amortization of purchased intangible assets and $10 million of expected gains from the sale of fixed assets,

projected interest expense, investment income and other income, net, of approximately $4 million and

a projected effective tax rate of 27 percent.

For fiscal 2024, the company is targeting modest organic revenue growth compared to fiscal 2023 and adjusted earnings per share of between $0.55 to $0.75.

The fiscal 2024 targets reflect the following assumptions and expectations, as compared to fiscal 2023:

a decline in volume from large corporate customers (which is expected to improve over the course of the year), partially offset by volume growth across the customer segments of education, health and small-to mid-sized corporate customers,

an improvement in gross margin to between 30.5 and 31.5 percent, primarily driven by projected pricing benefits, net of moderate inflation, and

increased operating expenses including higher investments in strategic initiatives, higher employee costs and approximately $17 million of amortization of purchased intangible assets.

"Building off the momentum of our improved performance in fiscal 2023, our fiscal 2024 targets reflect the continuation of our profitability improvement efforts and investments in our strategy to drive broader revenue growth," said Sara Armbruster. "We are committed to driving higher shareholder returns as we focus on the successful execution of our strategy."

Business Segment Footnotes

The Americas segment serves customers in the U.S., Canada, the Caribbean Islands and Latin America, with a comprehensive portfolio of furniture and architectural products marketed to corporate, government, healthcare, education and retail customers through the Steelcase, Coalesse, AMQ, Smith System, Orangebox, Viccarbe and Halcon brands.

The EMEA segment serves customers in Europe, the Middle East and Africa primarily under the Steelcase, Coalesse, Orangebox and Viccarbe brands, with a comprehensive portfolio of furniture and architectural products.

The Other category includes Asia Pacific and Designtex. Asia Pacific serves customers in Australia, China, India, Japan, Korea and other countries in Southeast Asia primarily under the Steelcase brand with a comprehensive portfolio of furniture and architectural products. Designtex sells textiles, wall coverings and surface imaging solutions specified by architects and designers directly to end-use customers through a direct sales force primarily in North America.

Corporate expenses include unallocated portions of shared service functions such as information technology, corporate facilities, finance, human resources, research, legal and customer aviation, plus deferred compensation expense and income or losses associated with company-owned life insurance.