HNI Reports Sales Climbed 18.2% for First Quarter Fiscal Year 2022

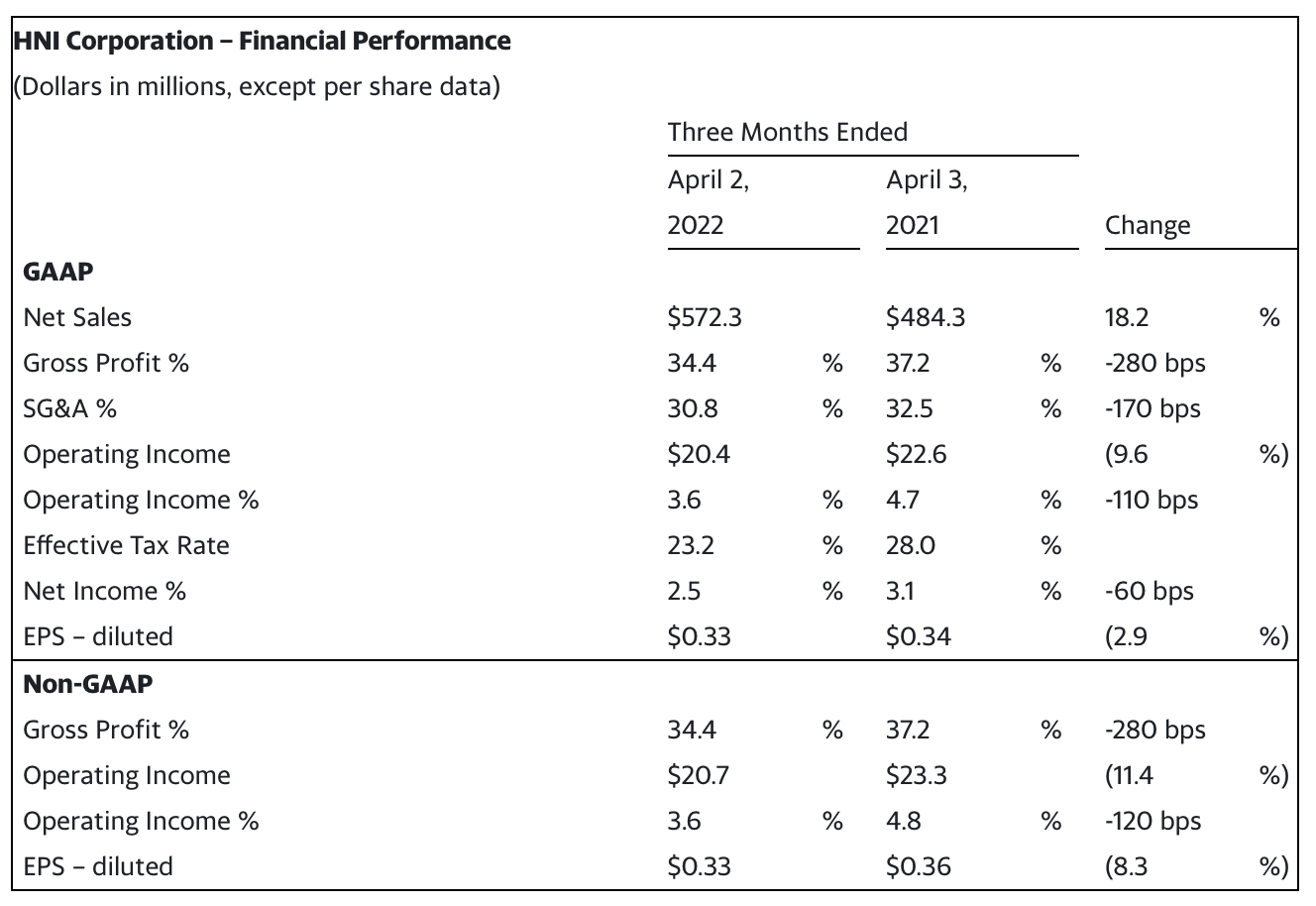

HNI Corporation today announced sales for the first quarter ended April 2, 2022 of $572.3 million and net income of $14.2 million. GAAP net income per diluted share was $0.33, compared to $0.34 in the prior year. Non-GAAP net income per diluted share was $0.33, compared to $0.36 in the prior year.

First Quarter Highlights

Positive price-cost and sequential gross profit margin improvement. The Corporation delivered positive price-cost, despite record levels of inflation during the quarter. This, along with the benefits of the previously discussed business simplification and labor capacity actions, helped improve gross margin from fourth quarter 2021 levels.

Strong revenue growth. The Corporation generated revenue growth of more than 18 percent driven by pricing actions, volume improvement, and the benefits of acquisitions completed in the prior year.

"Our initiatives to improve long-term profitability are on-track and delivering results. These include pricing actions to improve price-cost, strategic growth initiatives, multiple business simplification actions, and efforts to expand labor capacity. We expect noteworthy improvement as 2022 progresses driven by margin expansion in our Workplace Furnishings segment and strong growth in Residential Building Products," stated Jeff Lorenger, Chairman, President, and Chief Executive Officer.

First Quarter Summary Comments

Consolidated net sales increased 18.2 percent from the prior-year quarter to $572.3 million. On an organic basis, sales increased 15.3 percent year-over-year. The acquisition of residential building products companies in 2021 increased year-over-year sales by $14.0 million. A reconciliation of organic sales, a non-GAAP measure, follows the financial statements in this release.

Gross profit margin compressed 280 basis points compared to the prior-year quarter. This decrease was driven by price-cost dilution and lower net productivity, partially offset by higher volume.

Selling and administrative expenses as a percent of sales decreased 170 basis points compared to the prior-year quarter. The decrease was driven by dilution from price realization along with lower variable compensation, partially offset by higher core SG&A, increased freight costs, and higher investment spend.

Net income per diluted share was $0.33 compared to $0.34 in the prior-year quarter. The decrease was driven by lower productivity, higher core SG&A, and higher investment spend, partially offset by higher volume. Non-GAAP net income per diluted share was $0.33 compared to $0.36 in the prior-year quarter.

First Quarter Orders

Orders in the Workplace Furnishings segment excluding the impacts of restructuring, increased more than 10 percent year-over-year led by price realization and strength with small to mid-sized customers. That strength was offset somewhat by continued softness with contract customers.

Orders in the Residential Building Products segment increased 25 percent organically compared to the prior-year quarter. Remodel-retrofit and new construction order rates were both strong.

Workplace Furnishings net sales increased 16.6 percent from the prior-year quarter to $353.1 million.

Workplace Furnishings operating profit margin compressed 80 basis points year-over-year driven by operational investments, lower productivity, and higher core SG&A, partially offset by higher volume and favorable price-cost.

Residential Building Products net sales increased 20.8 percent from the prior-year quarter to $219.2 million. On an organic basis, sales increased 13.0 percent year-over-year. The impact of building products companies acquired in 2021 increased sales $14.0 million compared to the prior-year quarter.

Residential Building Products operating profit margin compressed 350 basis points year-over-year, driven by price-cost dilution, higher investment spend, and the impact of acquisitions.

Fiscal Year 2022 Outlook. The Corporation’s outlook for fiscal 2022 remains unchanged from the view provided in the fourth quarter 2021 earnings news release. Capacity additions and benefits from pricing actions are expected to drive strong revenue growth with accelerating profit improvement in the second half of 2022.

Workplace Furnishings revenue: pricing benefits, backlog normalization, and assumed market improvements are expected to drive revenue growth rates in the high teens to low twenties for 2022.

Residential Building Products revenue: pricing benefits, inorganic revenue from acquisitions closed in 2021, and continued benefits from multiple growth initiatives are expected to fuel growth rates in the high teens for 2022, on top of 25 percent organic growth generated by the segment in 2021.

Seasonality: earnings seasonality is expected to be more weighted to the back half of 2022 than in recent years when approximately 70 percent of total profit was generated during the second half.

Second Quarter 2022: the Corporation expects second quarter profitability to be near levels generated in the first quarter of 2022. On a sequential basis, the benefit from additional Workplace Furnishings volume is expected to be mostly offset by the normal seasonal step-down in Residential Building Products sales and labor capacity investments.

Balance Sheet: the Corporation expects to maintain a strong balance sheet throughout 2022. Low leverage and continued free cash flow generation are expected to provide ample capacity for continued investment, M&A, dividend payments, and share buyback activity.

Concluding Remarks

"I remain optimistic about our opportunities to grow revenue and earnings despite inflationary pressures and a dynamic environment. We continue to take actions to improve the long-term profitability of our Workplace Furnishings segment, where we are focused on margin expansion. In our Residential Building Products segment, we remain focused on driving strong top line growth, by leveraging our differentiated business model," Mr. Lorenger concluded.