The Monday Morning Quarterback

The Weekly Newsletter of the Contract Furniture Industry

Your Interface to the Commercial Furnishings Universe

Our latest issues

Subscribers can click HERE to order a past issue.

IN THIS ISSUE: We track continued softness in architecture and nonresidential construction as year-end billings remain below growth territory, projects are delayed, and hiring slows—even as some firms hold onto meaningful backlogs and pockets of regional strength emerge. We examine how coworking, hybrid models, and flight-to-quality leasing are beginning to stabilize office vacancies nationally and in select markets like Denver, while Manhattan enters its next adaptive phase. On the corporate front, we cover showroom expansion and retail-forward strategies, senior leadership appointments, brand recognition at the highest industry levels, and a high-stakes legal fight threatening the future of major design centers. Product and design coverage spans new systems for adaptable, powered, acoustic, and outdoor environments; expanded seating and accessories collections; and lighting, waste, and material innovations with strong sustainability narratives. We also explore how AI is reshaping architecture and workplace strategy, the growing gap between frontline and knowledge workers, shifting remote-work patterns by city, skepticism around the four-day workweek, and the sobering reality of 2025 job losses. Rounding out the issue are features on future-ready workplaces, standout global projects, sustainability funding, notable events and exhibitions, upcoming industry gatherings, awards, podcasts, and a hard-nosed piece of buying advice that applies present-day market logic to vintage design nostalgia.

IN THIS ISSUE: Creative Office Resources pushes further west with its acquisition of HB Workplaces, while DIRTT Environmental Solutions reshuffles its leadership to double down on technology and industrialized construction. An ethics controversy involving a sitting state senator and furniture contracts raises uncomfortable questions about competition and regulation in the interiors industry. Office demand shows renewed momentum, from AI-driven leasing activity in Silicon Valley to declining prime downtown vacancies nationwide, even as nonresidential construction remains uneven outside of booming data centers. Momentum expands its acoustic reach through an exclusive partnership with Autex, as Knoll rolls out a new system aimed at privacy, ergonomics, and flexibility in evolving workplaces. Broader forces—from Elon Musk’s sweeping predictions about AI replacing doctors and redefining work, to microshifting, fashion’s influence on interiors, and the growing case against inflexible corporate real estate—frame a workplace landscape in rapid transition. The issue also includes Office Revolution’s move into Kansas City and much, much more.

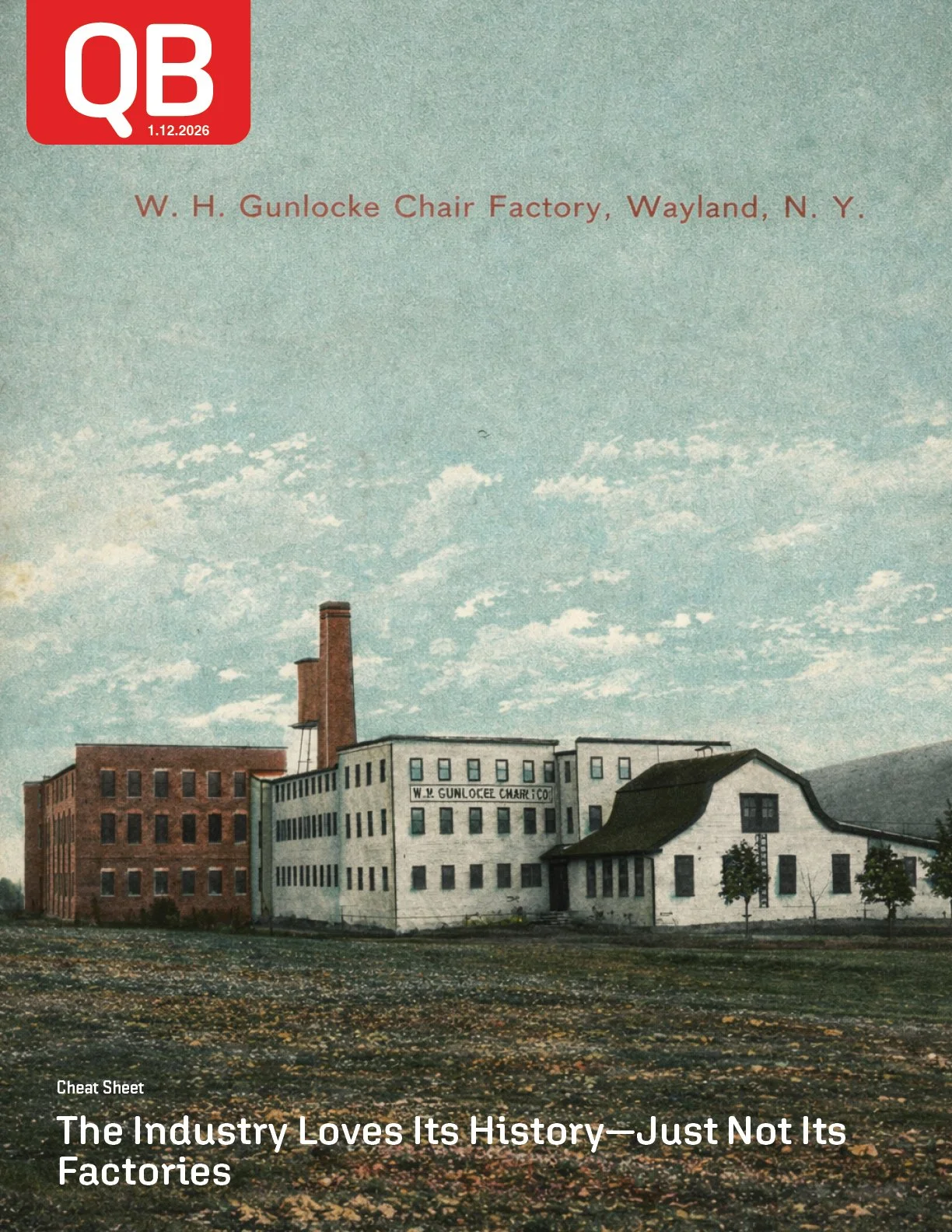

IN THIS ISSUE: This week’s issue captures an industry caught between celebrating its past and systematically dismantling the physical infrastructure that created it, as manufacturers increasingly mine archives and revive authorized legacy designs while simultaneously shuttering historic plants, most notably HNI’s planned closure of Gunlocke’s 124-year-old Wayland, New York facility. Alongside this central tension, the news reflects accelerating consolidation and optimization across the sector—from Okamura’s restructuring and DIRTT’s facility exit to European expansion plays by Holmris B8—while Adam Sandow continues assembling a vertically integrated media, data, and specification ecosystem that now touches nearly every stage of the A&D workflow. Macroeconomic signals remain mixed and largely unsupportive, with manufacturing and construction jobs declining, office demand recovering selectively in top-tier markets, and data center growth offering little practical upside for contract furniture makers. Design and workplace coverage reinforces the same theme of authenticity over excess, with renewed emphasis on craft, wellness, and human judgment in an AI-shaped workplace, even as AI’s real impact appears more evolutionary than disruptive. Taken together, the issue underscores a clear contradiction: the industry is finding new commercial value in history, provenance, and narrative at the exact moment it is losing the factories, labor, and lived continuity that made those stories real.

IN THIS ISSUE: The January 5, 2026 issue of MMQB positions the new year as a forced reset for the contract furniture and workplace design industry, shaped by economic volatility, cultural friction, and a rapidly changing customer base. The lead essay examines the pending absorption of Steelcase by HNI Corporation as a defining test of scale, dealer realignment, and innovation, set against ongoing tariff instability, rising bankruptcy risk, and cautious capital spending. At the same time, the issue identifies artificial intelligence companies—led by Nvidia, OpenAI, and Anthropic—as the most important growth customers for 2026, driving office leasing and influencing how workplaces are being designed for dense collaboration, durability, and real use. Coverage also explores workplace culture tensions, early signs of office market stabilization in cities like San Francisco and Manhattan, and supporting data on tariffs, bankruptcies, container pricing, industry stocks, and the Aeron Used Chair Index, reinforcing the conclusion that 2026 will reward companies that understand who their real customers are now and design, price, and operate accordingly.

IN THIS ISSUE: This week’s MMQB data points all rhyme: office life is getting busier, but the pipeline is still a little weird. San Francisco’s office demand is surging (up 112% year over year) as leasing and transit rebound, while New York’s recovery is steadier and more incremental; meanwhile the Kastle numbers just posted fresh post-pandemic highs, with the 10-city weekly average hitting 56.3% and a new single-day record of 66.0% as even “all buildings” claw closer to the A+ crowd. The AIA/Deltek ABI is still stuck in contraction mode (45.3 in November—13 straight months down), underscoring that “more butts in seats” doesn’t automatically translate into a booming design backlog. On the manufacturing side, MillerKnoll delivered mixed fiscal Q2 results—orders up and retail (hello, DWR) showing real momentum—while Avanto’s acquisition of Agentic Dream is another signal that the industry thinks AI and workflow automation are moving from buzzword to operating system; add in Drewry’s container index ticking up again, a softer used Aeron market in key cities, and a grab bag of conversion/coworking headlines, and you’ve got a sector heading into 2026 with improving demand signals, cautious planning, and a lot of “optimize the messy middle” energy. Happy and safe holidays and a wonderful New Year to everyone—MMQB returns Monday, January 5, 2026.

IN THIS ISSUE: This week’s MMQB is anchored by the closing of the Steelcase–HNI deal, a rare, industry-shaping merger that effectively ends meaningful M&A at the top of the contract furniture market and shifts the center of gravity to Muscatine, Iowa. We track the ripple effects of tariffs and rising costs on construction activity, project abandonments, and manufacturers’ margins, alongside earnings updates from Virco and a refinancing move by DIRTT. Office occupancy rebounds sharply after Thanksgiving even as leasing remains selective, while employee fatigue, layoffs, and AI anxiety continue to shape workplace culture. Rounding out the issue are new product launches, design trends, sustainability stories, and vintage perspective.

IN THIS ISSUE: MillerKnoll Debuts First Showroom in Mainland China / HNI Corporation and Steelcase Inc. Shareholders Approve Proposals in Connection with HNI’s Proposed Acquisition of Steelcase / Steelcase shareholder lawsuit dismissed / America's "greatest architect" Frank Gehry dies aged 96 / Office Construction Remains Cautious as Utilization Stabilizes / All Census Office Regions See Positive Demand for First Time Since 2021 / Remembering Robert A.M. Stern, Starchitect Who Revived Limestone Glamour / Delayed Recovery, Economic Angst Darken CRE's December Mood / The Future of Work Is Slow: Why Intentional Working Will Redefine 2026 and Beyond / Hybrid Era Reshapes Office Winners and Laggards / Commute Times Approach Pre-Pandemic Levels / 47% Of Americans Are Polyworking—And Most Say It’s No Longer Optional / "Lofty white" Cloud Dancer named Pantone Colour of the Year 2026 / and much more…

IN THIS ISSUE: Shareholder sues Steelcase over ‘tainted’ $2.2B sale agreement with HNI Corp. / DOGE Disbands 8 Months Early, With Most Lease Terminations Rescinded / DIRTT Announces Board and Leadership Updates / Trump White House spending $1.75 million on new furniture, redecorating / German furniture company König + Neurath files for insolvency after 100 years / Bright Spots Emerge Amid Office Market’s Post-Pandemic Shakeup / Construction Starts Jump 21% As Megaprojects Break Ground / NYC Office Development Poised For Biggest Opportunity Since GFC, Landlords Say / For the first time in its history, ORGATEC has an overarching theme / Aging Workforces Are Becoming A Major Drag On Economic Growth, New EBRD Report Finds / AI and robotics could replace as many as 40 percent of US jobs, McKinsey report suggests / Making Work Fun Is The Secret To Getting More Done / Cisco Wins RTO Culture ‘Tug of War’ for Its California Workplaces / Hybrid Habits Hold Firm as Friday Office Visits Lag / Flexible Workspaces And The Rise Of Corporate Downsizing / and much more…

IN THIS ISSUE: ABI October 2025: Billings continue to decline at architecture firms / German office manufacturer seeks self-administration to secure future / MillerKnoll Strengthens Taiwan Presence by Appointing York Business Interiors as its Authorised Dealer / U.S. Office Construction Activity Stalls As Vacancy Holds Near Record Highs / Economist: Office Leasing Could Rebound as Workforce Outgrows Current Space / Foot Traffic To The Office Steps Up In Q3, Survey Finds / Ford gets a huge new headquarters for an ambitious new era / Robert Propst Invented the Cubicle. But Don’t Blame Him if You Hate It. / What JPMorgan’s New HQ Can Teach Landlords About Workplace Demand / Office Market Recovery Is Real Only For Elite Districts, Leaving Most Cities Struggling / Designing for Perpetual Change: JLL's Stephen Jay on Building Workplaces People Choose to Use / How Acoustic Design Is Evolving for the Modern Workplace / Creating Spaces That Adapt, Inspire and Connect – The New Workplace Experience / and much more…

IN THIS ISSUE: HON Reimagines Chicago Presence with New Fulton Market Space / The Future of Work Is Being Built by Furniture: Europe’s Office Market Heads Toward $25.63 Billion / Designing a Better Tomorrow: MillerKnoll’s 2025 Better World Report / Danish office furniture brand pulls out of UK after costly expansion / CEKA emerges from insolvency with new investor partnership / Data Center Work Holds Up the Entire Construction Industry / Sun Belt Office Markets Heat Up as Companies Migrate South / Los Angeles Lags As The Country's Office Market Shows Signs Of Healing / Can MillerKnoll’s Saudi Expansion Redefine Its Global Growth Ambitions? / Why Experience — Not Efficiency — Is Now The Workplace Design Metric That Matters Most / Glassdoor Data Exposes Rising Worker Frustration Across U.S. Companies / Is The Flex Industry Growing Well — Or Just Getting Bigger? / and much more…

IN THIS ISSUE: DIRTT Reports Steep Sales Decline and $3.5 Million Loss as Tariffs Bite and Projects Stall / Creative Office Resources Expands to the Midwest with Acquisition of Continental Office / Pedrali makes debut at Interihotel with immersive hospitality installations / US residential furniture orders dip slightly as consumer confidence remains muted / Big Tenants, Small Leases: Changing Dynamics in Office Leasing / Chicago's Office Utilization Is Steadily Creeping Up / Shaky Economy, Travel Slowdown Hit Hospitality Companies / The chair of tomorrow / The Next Workplace Blueprint Requires a Technology-Centric Approach / 4 Generations, One Office / More Than Just a Seat: The Lounge as the New Travel Destination / Countries where the workweek is getting shorter fastest / Return-to-Office Mandates Are Driving Women In Tech To Quit, Survey Shows / Rising Costs, Shifting Market Have Office Landlords Tightening The Purse Strings On TI / WeWork CEO On The Flex Boom — ‘We’re Not Taking Down Space Fast Enough To Meet Demand’ / and much more…

IN THIS ISSUE: Commercial Furniture Dealers Brace for Soft Landing / HNI Posts Solid Q3 with Workplace Furnishings Momentum and Steelcase Deal on the Horizon / Humanscale opens APAC headquarters and showroom in Singapore / U.S. Office Market Sees First Vacancy Drop In Years As Forecasts Turn Positive / The Office Market Is Shrinking — Flex Space May Be The Only Way Back To Growth / Office Demand Fractures Along Remote Work Lines / Fall High Point Market Recap / Tenant Buildout Costs Outpace Allowances as Material Prices Climb / Manhattan Property Sales Surge To Highest Quarterly Volume in Three Years / Trump Fires Federal Design Board Ahead Of Ballroom, Arch Projects / U.S. Office Market Rebounding Faster Than Expected, CoStar Finds / Several Insiders Invested In Virco Mfg Flagging Positive News / Return-to-office mandates are about to backfire / Upholstery tariffs get the headlines. De minimis is the headache / Designed for What Purpose? Rethinking the Role of the Office / We Can’t Optimize Flexible Work Until We Agree On What It Actually Is / Coworking’s Quiet Takeover Goes Coast to Coast / and much more…

The latest industry career positions available for Contract.Careers